Newsbreak

-

Area Police Blotter

Vidalia Police Department reports the following arrests:

Doleman, Charles – Vidalia – Theft by Shoplifting.

Stokes, Derrick – Vidalia – DI; Failure to Maintain Lane.

Harmon, Michael – Vidalia – Criminal Damage to Property.

Toombs County Sheriff’s Office reports the following arrests:

Cesar,

...- Information

- Newsbreak | | 23 April 2024 | 11:43

- 642 hit(s) |

-

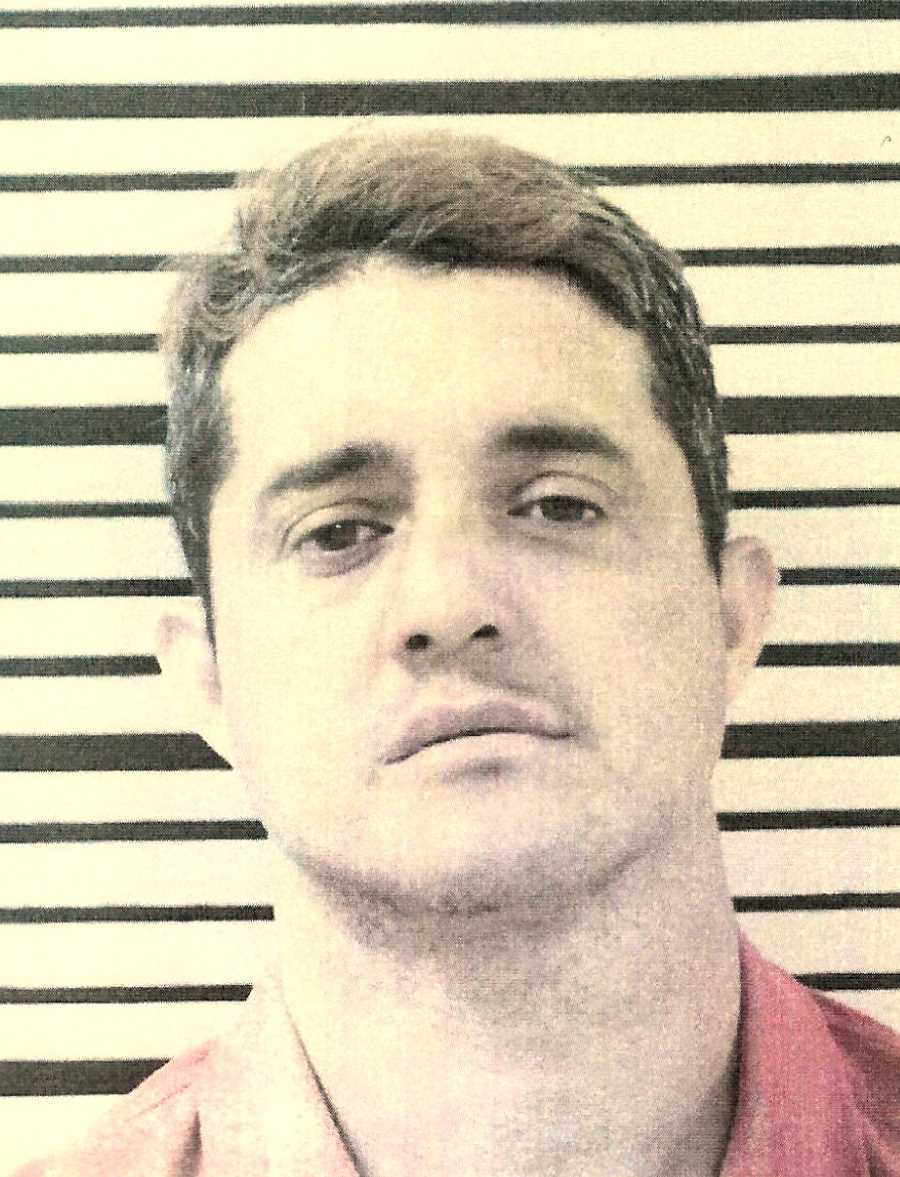

Driver in Friday Morning Accident Charged With Homicides by Vehicle

The driver of a pickup truck that was involved in an accident Friday morning on Loop Road and Old Normantown Road has been charged with two counts of homicide by vehicle, driving while unlicensed, and stop signs and yield signs violation.

Freddy Jose Suarez Juarez was behind the wheel of the truck

...- Information

- Newsbreak | | 23 April 2024 | 11:35

- 1386 hit(s) |

-

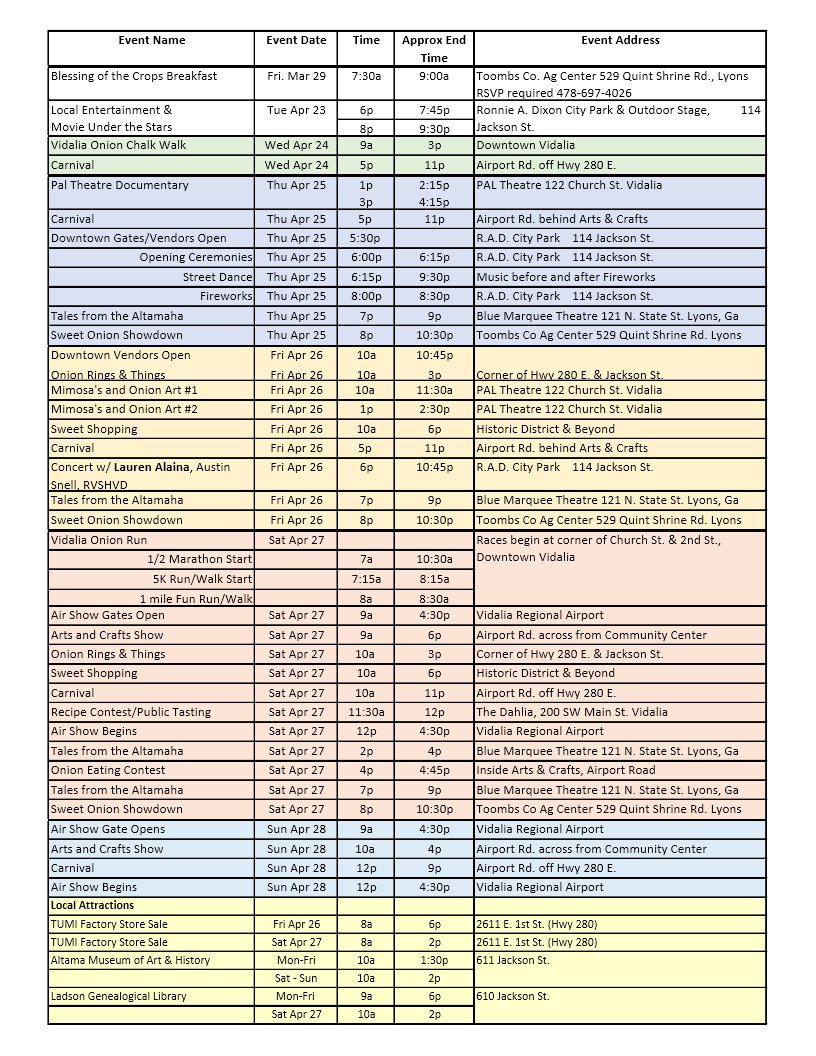

Vidalia Onion Festival Schedule of Events

Below is a complete list of events for this week's 47th Annual Vidalia Onion Festival. More info is available at www.vidaliaonionfestival.com or you can download the Vidalia Onion Festival app.

- Information

- Newsbreak | | 22 April 2024 | 11:55

- 1351 hit(s) |

-

Two Killed in Friday Morning Accident

On Friday, April 19th, 2024, at approximately 9:01 am, Toombs County 911 Dispatch received a call of a wreck involving a white Ford truck and a green Chevrolet car at the intersection of GA Hwy 130 east and Old Normantown Road. Upon arrival, deputies observed that both vehicles were northwest of

...- Information

- Newsbreak | | 19 April 2024 | 15:48

- 3710 hit(s) |

-

Area Police Blotter

Vidalia Police Department reports the following arrests:

Smith, Samontray – Vidalia – Simple Obstruction; Disorderly Conduct; Terroristic Threats.

Collins, Michael – Collins – Theft by Shoplifting.

Trull, Mark Hunter - Vidalia - Theft by Taking; Entering Auto (2 Counts).

Walker, Lashunda - Vidalia -

...- Information

- Newsbreak | | 19 April 2024 | 07:34

- 3602 hit(s) |

-

Lane Named Vidalia Lady of the Year

Angela Lane, Vidalia 2023 Lady of the Year, with her family.

When Angela Lane moved to Vidalia several years ago, she hit the ground running, and the energetic and community-loving woman has never slowed down. She immediately wrapped herself in volunteering and It’s that “giving back attitude” for her

...- Information

- Newsbreak | | 18 April 2024 | 16:33

- 1101 hit(s) |

-

Toombs County Jurors Should Not Report

Toombs County Clerk of Courts Nancy Pittman reported Thursday morning that Toombs County jurors summoned for jury duty for Monday, April 22, do NOT need to report. All cases have been settled or have been continued for the term.

- Information

- Newsbreak | | 18 April 2024 | 09:24

- 267 hit(s) |

-

Bishop Named 2023 Vidalia Man of the Year

(L to R): Zack Fowler, Presenter and 2018 Man of the Year; Brian Bishop, 2023 Man of the Year; and Lisa Bishop, wife of this year's recipient.

A familiar voice to listeners of the radio stations in Vidalia and the 2018 Man of the Year came home back to Vidalia Tuesday night to announce the name of the

...- Information

- Newsbreak | | 17 April 2024 | 15:49

- 1117 hit(s) |

-

STC Students Attended GSGA Conference

(L-R) Southeastern Technical College Student Government Association Members Whitney Williams and Sabrina McLeod

(L-R) Southeastern Technical College Student Government Association Members Whitney Williams and Sabrina McLeodApril 16, 2024 – Two students from Southeastern Technical College attended the Georgia State Leadership Level Up Conference and competed in Student Government Association competitions in

...- Information

- Newsbreak | | 16 April 2024 | 14:16

- 466 hit(s) |

Sportsbreak

-

Sports & Scores This Week (4-22-24)

April 22-- Here are the latest sports schedules and scores for the week.

Monday, April 22

Baseball: Braves 3, Marlins 0

Tuesday, April 23

Baseball: Marlins at Braves 7:20pm (News Talk WVOP-FM 105.3)

Treutlen at Baconton Charter (DH) 1:30pm (GHSA Class A Division II First Round State Playoffs)

...- Information

- Sportsbreak | | 22 April 2024 | 08:56

- 190 hit(s) |

-

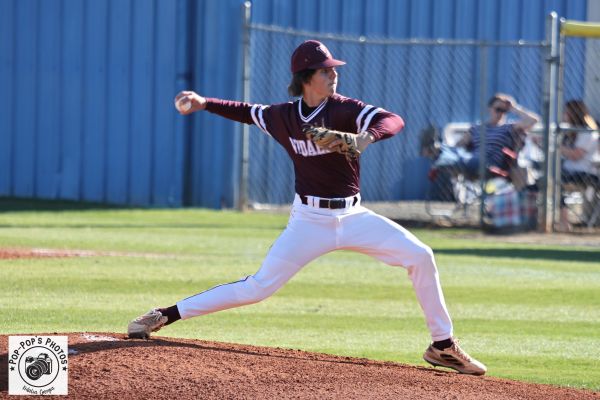

RTCA Sweeps Memorial claims Region Title

RTCA 7 Memorial 1

...

The Crusaders traveled to Savannah to play Memorial day school Monday and behind the pitching of Britton Tabor came away with a 7-1 win in game 1 of the 3 game series. Tabor pitched 6 and 2/3 innings giving up 1 earned run and 4 hits while striking out 13. The offense was also- Information

- Sportsbreak | | 22 April 2024 | 07:04

- 93 hit(s) |

-

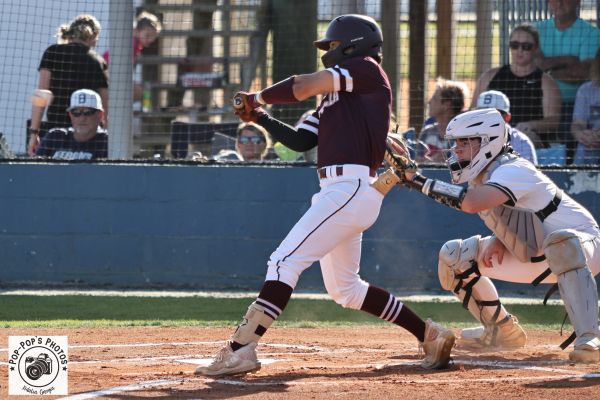

Bulldog Baseball Closes Out Regular Season with Non-Region 10-5 Senior Night Victory Over Metter

The Toombs County Bulldogs Baseball team ended their season with a commanding 10-5 victory against the Metter Tigers this past Tuesday night.

The Tigers initially took the lead, when a Tiger doubled to score the opening run. However, the Bulldogs quickly responded, snatching the lead in the bottom

...- Information

- Sportsbreak | | 21 April 2024 | 15:16

- 120 hit(s) |

-

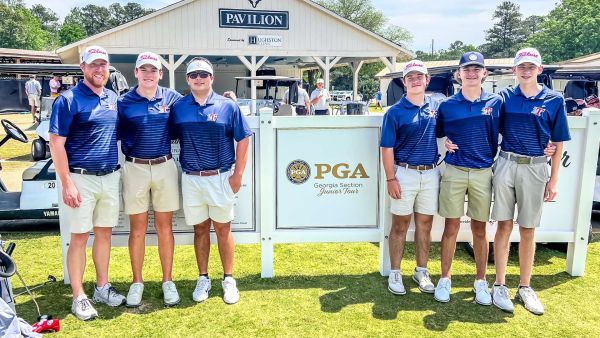

Toombs County Men’s Golf Team Shines at 48th Larry Gaither Golf Invitational

On Monday and Tuesday (April 15-16), the Toombs County men’s golf team showcased their skills at the prestigious 48th Larry Gaither Golf Invitational in Columbus, Georgia. This event, formerly known as the Hardaway Invitational, holds the distinction of being the second longest-running high school golf

...- Information

- Sportsbreak | | 20 April 2024 | 15:17

- 148 hit(s) |

-

7th Annual BPC Southern Classic Raises Over $30,000 for College

(Presenting Sponsor Tim Redding from Metter Ford with Dr. Steven Echols, President of Brewton-Parker College)

MOUNT VERNON — On Friday, April 5, 2024, Brewton-Parker College (BPC) hosted its 7th Annual Southern Classic Golf Tournament presented by Metter Ford at the Willow Lake Golf Club in

...- Information

- Sportsbreak | | 17 April 2024 | 18:08

- 223 hit(s) |

-

Lady Crusaders Get Win Over Lady Eagles

It’s 4.6 miles from Robert Toombs to Vidalia Heritage. VHA hosted the lady crusaders for middle school and varsity soccer games Monday, April 15th. This was the first middle school contest the schools had played against each other. The Crusaders would come away victorious with a 2-0 win. Defender

...- Information

- Sportsbreak | | 17 April 2024 | 06:55

- 211 hit(s) |

-

Former Lady Indian Myesha Hall Setting Records at Truett McConnell

Myesha Hall a 2021 graduate of Vidalia High School is making her mark at Truett McConnell as she continues to dominate on the track.The former state champion in long jump is also the 2022 NAIA National Champion in long jump, the first ever in the event in TMU history. Myesha is still on track for bigger

...- Information

- Sportsbreak | | 16 April 2024 | 14:19

- 271 hit(s) |

-

Toombs Co Track and Field Competes in Last Home Event Before Shifting Focus to Region

Last week TCHS Track and Field teams competed in their last home meet of the season.

...

Teams Participating in the meet included; cross town rivals Vidalia, Wheeler County High School and Portal High School from Bulloch County. The final meet followed a bit different format than your usual high- Information

- Sportsbreak | | 16 April 2024 | 09:48

- 291 hit(s) |

-

Indians End Season With Loss to Herons

Vidalia would struggle at the plate and drop the final game of the season on the road 2-0 to Brantley Co.

The Indians would only have four hits on the night with two of them coming from the bat of Ian Moye who was 2-3 on the night.

Jackson Berry would pitch well on the night in a losing effort. The

- Information

- Sportsbreak | | 16 April 2024 | 09:35

- 324 hit(s) |

Community Calendar

-

-

-

-

Vidalia Onion Festival and Technology

To stay in-the-know during the 2024 Vidalia Onion Festival, you can use this QR code to scan and go to the Vidalia Onion Festival website, or you can download the VOF app from your phone's app store. Either way, it's quick, easy, and you'll have all the latest info on the festival literally within the

...- Information

- Community Event | | 16 April 2024 | 14:23

- 185 hit(s) |

-

-

-

-

-

Obituaries

-

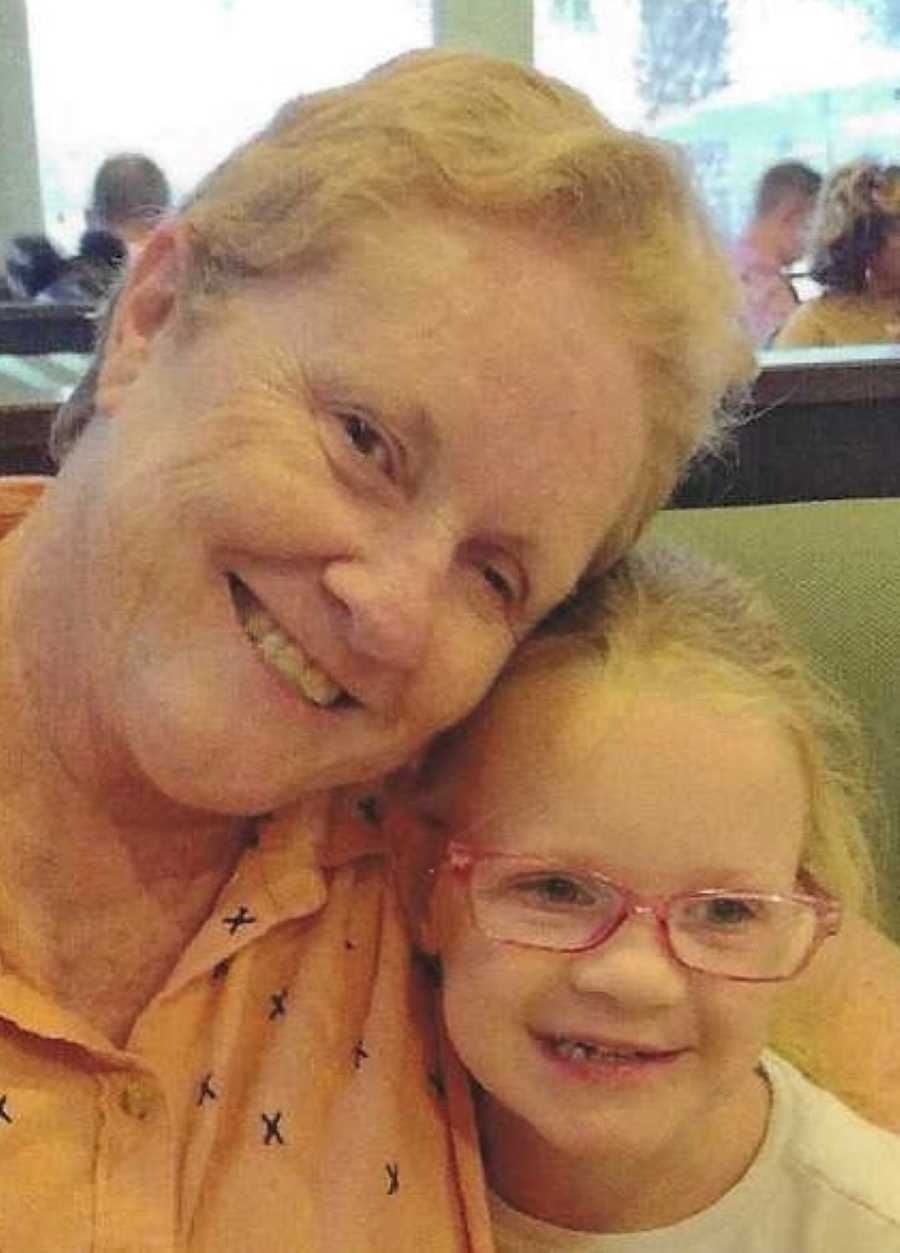

Mrs. Kay Aaron, Vidalia

A “Celebration of Life Service” for Mrs. Kay Jamelle Rotton Aaron of Vidalia will be held Thursday, April 25, 2024 at 11:00 AM at her residence located at 541 Newsome Road, Vidalia, GA in Montgomery County. Reverend Baron Powell will officiate. Mrs. Aaron died Monday, April 22, 2024. Mrs. Aaron,...

A “Celebration of Life Service” for Mrs. Kay Jamelle Rotton Aaron of Vidalia will be held Thursday, April 25, 2024 at 11:00 AM at her residence located at 541 Newsome Road, Vidalia, GA in Montgomery County. Reverend Baron Powell will officiate. Mrs. Aaron died Monday, April 22, 2024. Mrs. Aaron,... - Information

- Obituary | | 23 April 2024 | 13:49

- 243 hit(s) |

-

Mrs. Marion Peterson, Lyons

Mrs. Marion Zeigler Peterson, age 89, of Lyons, died Sunday, April 21, 2024, at Haven Hospice in Lake City, Florida, following an extended illness. She was a native of Toombs County and lived in Lyons most of her life. She was a 1952 graduate of Toombs County High School, and retired from the...

Mrs. Marion Zeigler Peterson, age 89, of Lyons, died Sunday, April 21, 2024, at Haven Hospice in Lake City, Florida, following an extended illness. She was a native of Toombs County and lived in Lyons most of her life. She was a 1952 graduate of Toombs County High School, and retired from the... - Information

- Obituary | | 23 April 2024 | 12:33

- 169 hit(s) |

-

Mrs. Grace Meeks, Soperton

Mrs. Grace Parrish Meeks, age 90 of Soperton, Georgia passed away on Wednesday evening, April 17, 2024 at Langdale Hospice House in Valdosta, Georgia. Born in Treutlen, Georgia, she was the second of four girls born to the late Aubrey Talton Parrish and Mary Lucille McLendon Parrish. She grew up in...

Mrs. Grace Parrish Meeks, age 90 of Soperton, Georgia passed away on Wednesday evening, April 17, 2024 at Langdale Hospice House in Valdosta, Georgia. Born in Treutlen, Georgia, she was the second of four girls born to the late Aubrey Talton Parrish and Mary Lucille McLendon Parrish. She grew up in... - Information

- Obituary | | 22 April 2024 | 09:04

- 338 hit(s) |

-

Mrs. Sandra Cowart, Tarrytown

Mrs. Sandra Simons Cowart, age 78, beloved wife of Carl Cowart of Tarrytown passed away on Thursday morning, April 18, 2024 at Community Hospice in Vidalia. Born in Treutlen County, she was the eldest of two daughters born to the late George Dewey Simons and Loyce Poole Simons. She grew up in the...

Mrs. Sandra Simons Cowart, age 78, beloved wife of Carl Cowart of Tarrytown passed away on Thursday morning, April 18, 2024 at Community Hospice in Vidalia. Born in Treutlen County, she was the eldest of two daughters born to the late George Dewey Simons and Loyce Poole Simons. She grew up in the... - Information

- Obituary | | 22 April 2024 | 09:02

- 393 hit(s) |

-

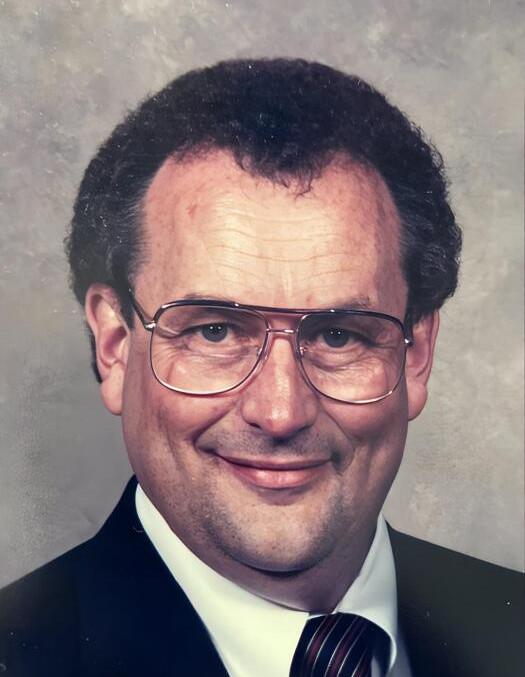

Mr. Henry “Mack” McCall, Vidalia

Mr. Henry “Mack” McCall, age 83, of Vidalia, died peacefully on Thursday, April 18, 2024, at his home, after an extended illness. He was a native of Montgomery County, a 1958 graduate of Vidalia High School, and attended Jacksonville University in Jacksonville, Florida. He lived in Jacksonville...

Mr. Henry “Mack” McCall, age 83, of Vidalia, died peacefully on Thursday, April 18, 2024, at his home, after an extended illness. He was a native of Montgomery County, a 1958 graduate of Vidalia High School, and attended Jacksonville University in Jacksonville, Florida. He lived in Jacksonville... - Information

- Obituary | | 19 April 2024 | 13:53

- 544 hit(s) |

-

Linda Anderson Webbe, Mt. Vernon

Linda Anderson Webbe, age 70, of Mt. Vernon, died Tuesday, April 16, 2024, at Memorial Health Meadows Hospital after an extended illness. She was a native of New Castle, England, but lived most of her life in Florida until moving to Mt. Vernon a year ago. She was a front end manager with...

- Information

- Obituary | | 17 April 2024 | 16:26

- 568 hit(s) |

-

Mrs. Jean Barnes, Vidalia

Mrs. Jean Colson Barnes, age 95 of Vidalia, died Tuesday, April 16, 2024, at Zebulon Park Health & Rehab in Macon, following an extended illness. She was a native of the Smyrna Church Community in Toombs County and was a 1945 graduate of Toombs Central School. She moved to Vidalia in 1953 and...

Mrs. Jean Colson Barnes, age 95 of Vidalia, died Tuesday, April 16, 2024, at Zebulon Park Health & Rehab in Macon, following an extended illness. She was a native of the Smyrna Church Community in Toombs County and was a 1945 graduate of Toombs Central School. She moved to Vidalia in 1953 and... - Information

- Obituary | | 17 April 2024 | 13:35

- 598 hit(s) |

-

Mr. Leo Johnson, Dublin

Mr. Leo Harry Johnson, age 91 of Dublin passed away on Tuesday morning, April 16, 2024 at Twelve Oaks Assisted Living Center in Dublin. Born in Laurens County, he was one of six and the last living child born to the late Leo Johnson and Rebecca Young Johnson. He grew up in Laurens County where he was...

Mr. Leo Harry Johnson, age 91 of Dublin passed away on Tuesday morning, April 16, 2024 at Twelve Oaks Assisted Living Center in Dublin. Born in Laurens County, he was one of six and the last living child born to the late Leo Johnson and Rebecca Young Johnson. He grew up in Laurens County where he was... - Information

- Obituary | | 17 April 2024 | 11:18

- 370 hit(s) |

-

Mr. B.T. Tapley, Vidalia

Mr. B.T. Tapley, age 89, of Vidalia, died peacefully on Monday, April 15, 2024, at the Community Hospice House in Vidalia after a brief illness. B.T. was born on September 19, 1934 in Soperton, Georgia to the late Blount and Ethel Bedgood Tapley. He was a 1953 graduate of Montgomery County High...

Mr. B.T. Tapley, age 89, of Vidalia, died peacefully on Monday, April 15, 2024, at the Community Hospice House in Vidalia after a brief illness. B.T. was born on September 19, 1934 in Soperton, Georgia to the late Blount and Ethel Bedgood Tapley. He was a 1953 graduate of Montgomery County High... - Information

- Obituary | | 17 April 2024 | 11:13

- 923 hit(s) |

Church Calendar

-

April 28--Homecoming in Cedar Crossing

April 28--Cedar Crossing Baptist Church invites you to their Homecoming 2024, Sunday April 28th at 10:30 (no Sunday School). The Browders will be ministering during the morning service. Dinner after so bring your favorite foods. Pastor Reece Mincey

April 28--Cedar Crossing Baptist Church invites you to their Homecoming 2024, Sunday April 28th at 10:30 (no Sunday School). The Browders will be ministering during the morning service. Dinner after so bring your favorite foods. Pastor Reece Mincey - Information

- Church Event | | 22 April 2024 | 11:55

- 52 hit(s) |

-

April 22-24--Spring Revival in Vidalia

April 22-24--First African Missionary Baptist Church, 206 Martin Luther King Jr Avenue in Vidalia, would like you to come to their Annual Spring Revival, April 22nd through April 24th at 7:30 each night with guest revivalist Reverend Arthur Gordon of Bethel Baptist Church in Macon and Jordan Stream Baptist Church in Toombsboro. Pastor, Dr. Carl Wardlaw Jr

April 22-24--First African Missionary Baptist Church, 206 Martin Luther King Jr Avenue in Vidalia, would like you to come to their Annual Spring Revival, April 22nd through April 24th at 7:30 each night with guest revivalist Reverend Arthur Gordon of Bethel Baptist Church in Macon and Jordan Stream Baptist Church in Toombsboro. Pastor, Dr. Carl Wardlaw Jr - Information

- Church Event | | 16 April 2024 | 09:50

- 178 hit(s) |

-

May 4--The Barber Family in Vidalia

May 4--Cornerstone Pentecostal Church, 377 South Thompson Road in Vidalia, would like you to join them for A Night of Worship with The Barber Family, Saturday May 4th at 6:00.

May 4--Cornerstone Pentecostal Church, 377 South Thompson Road in Vidalia, would like you to join them for A Night of Worship with The Barber Family, Saturday May 4th at 6:00. - Information

- Church Event | | 09 April 2024 | 11:59

- 165 hit(s) |

-

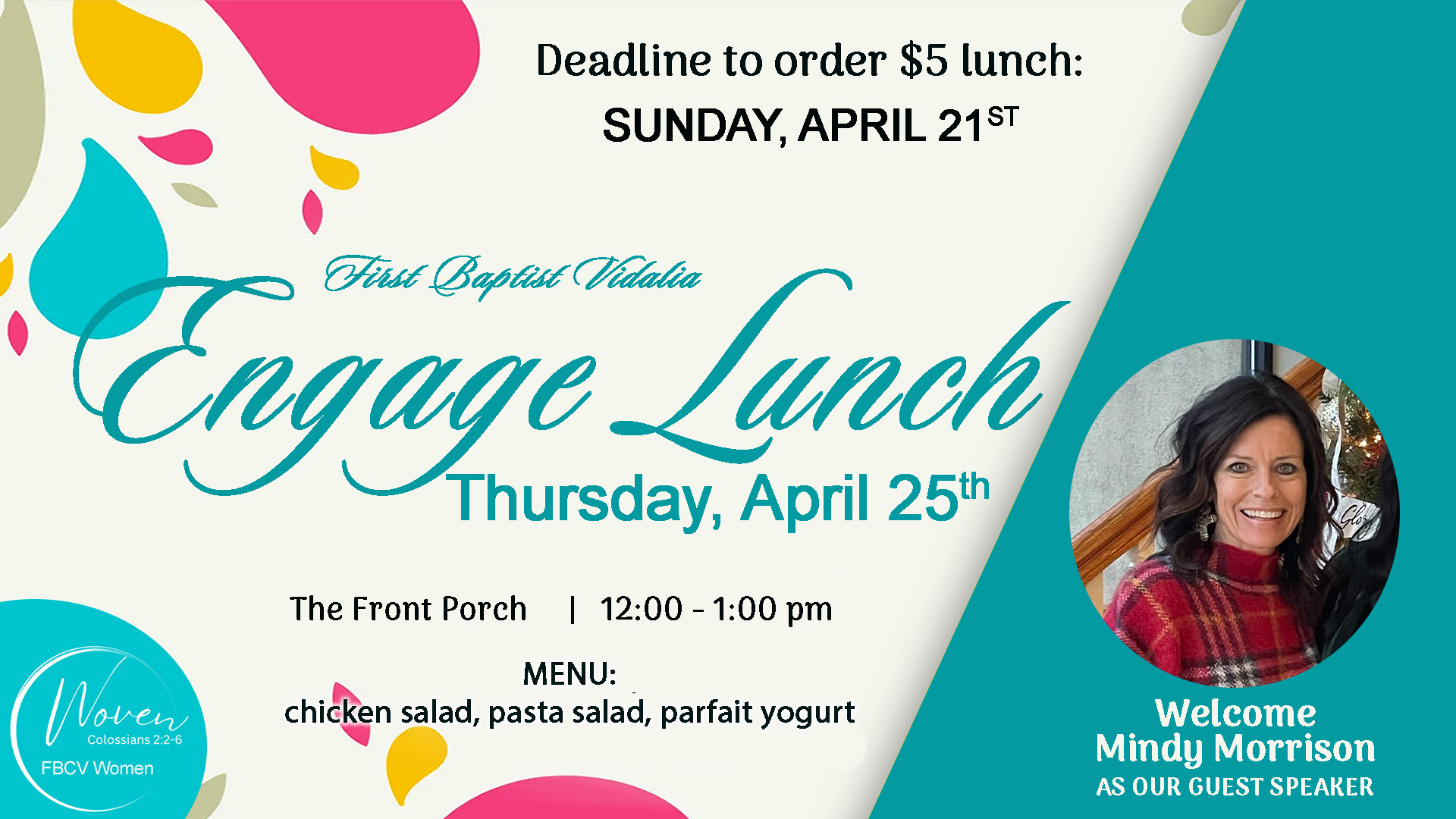

April 25--April Engage Luncheon in Vidalia

April 25--The Woven Women’s Ministry of First Baptist Church of Vidalia invites you to their monthly Engage Luncheon, Thursday April 25th at Noon on “The Front Porch” with Mindy Morrison. Lunch is Chicken Salad with pasta and yogurt parfait for $5 or bring your own lunch. Deadline to sign up online is April 21st. fbcvidalia.org /Current Events.

April 25--The Woven Women’s Ministry of First Baptist Church of Vidalia invites you to their monthly Engage Luncheon, Thursday April 25th at Noon on “The Front Porch” with Mindy Morrison. Lunch is Chicken Salad with pasta and yogurt parfait for $5 or bring your own lunch. Deadline to sign up online is April 21st. fbcvidalia.org /Current Events. - Information

- Church Event | | 09 April 2024 | 09:42

- 457 hit(s) |

-

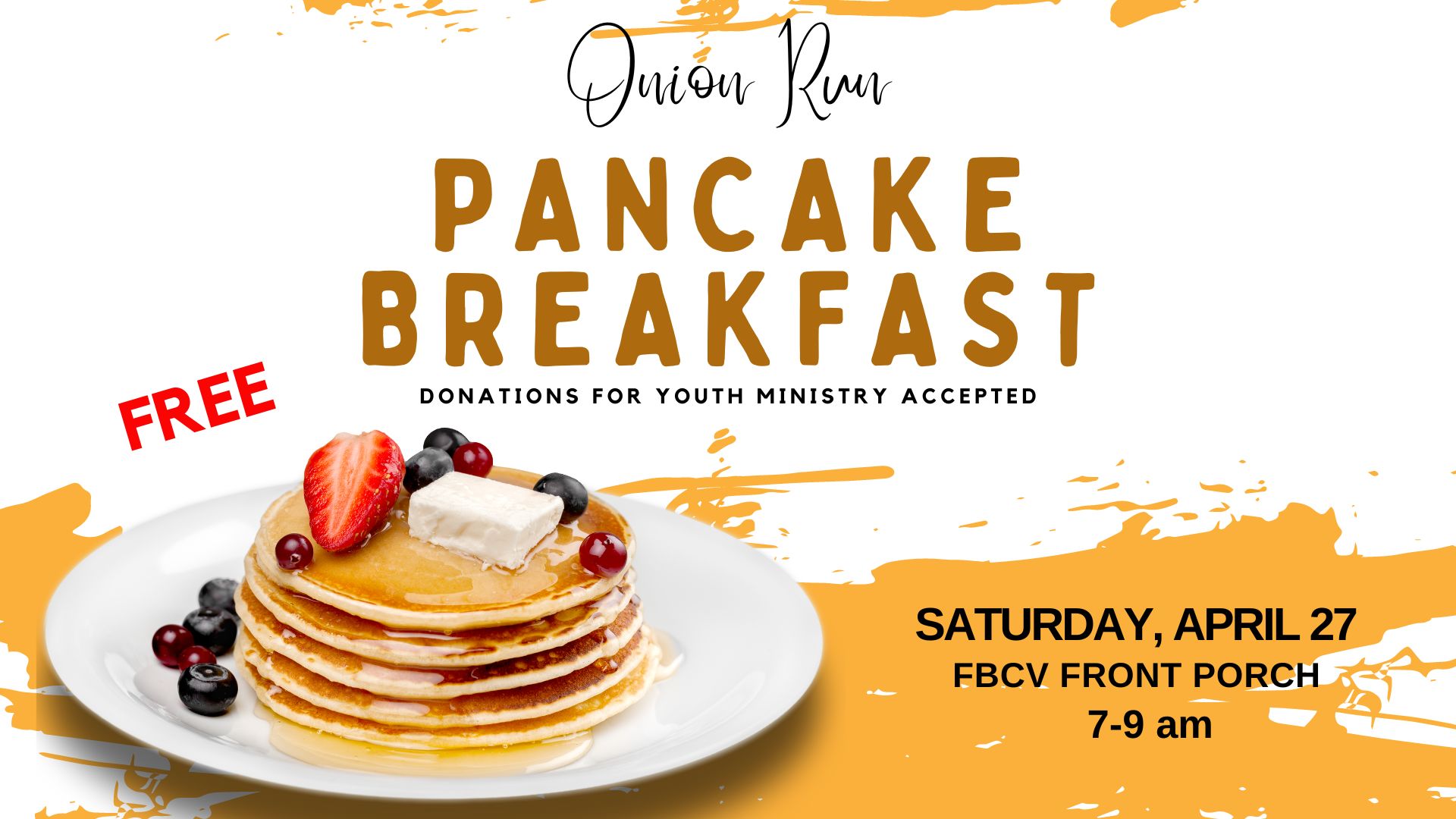

April 27--Pancake Breakfast for Youth Ministry during Vidalia Onion Run

April 27--First Baptist Church of Vidalia would like you to come to their Vidalia Onion Run Free Pancake Breakfast, Saturday April 27th from 7:00 to 9:00 on “The Front Porch”. Donations accepted for the Youth Ministry

April 27--First Baptist Church of Vidalia would like you to come to their Vidalia Onion Run Free Pancake Breakfast, Saturday April 27th from 7:00 to 9:00 on “The Front Porch”. Donations accepted for the Youth Ministry - Information

- Church Event | | 09 April 2024 | 09:35

- 416 hit(s) |

-

Pass it along with...CHURCH NEWS!

LET US GET YOUR MESSAGE TO THE PUBLIC WITH CHURCH NEWS! Thank you for using Church News on News-Talk WVOP 970 AM and 105.3 FM, and southeastgeorgiatoday.com. Submit your church events to us at least 2 weeks ahead of time for the greatest coverage and best results. Include the name of the church, the church address, name of the event, date & time of the event, location of the event if other than the church, and any special speakers involved. ** When including an image or images please send it as an attachment. Use the jpg format for all images ** Send it to JIM PERRY! Email jperry @ radiojones.com ---Please note that FAX is no longer available. Use email.

Thank you for using Church News on News-Talk WVOP 970 AM and 105.3 FM, and southeastgeorgiatoday.com. Submit your church events to us at least 2 weeks ahead of time for the greatest coverage and best results. Include the name of the church, the church address, name of the event, date & time of the event, location of the event if other than the church, and any special speakers involved. ** When including an image or images please send it as an attachment. Use the jpg format for all images ** Send it to JIM PERRY! Email jperry @ radiojones.com ---Please note that FAX is no longer available. Use email. - Information

- Church Event | | 03 November 2021 | 12:30

- 6989 hit(s) |

Meet The Staff

-

General Manager

-

Program Director

-

Program Director

-

Traffic / News Director