Newsbreak

-

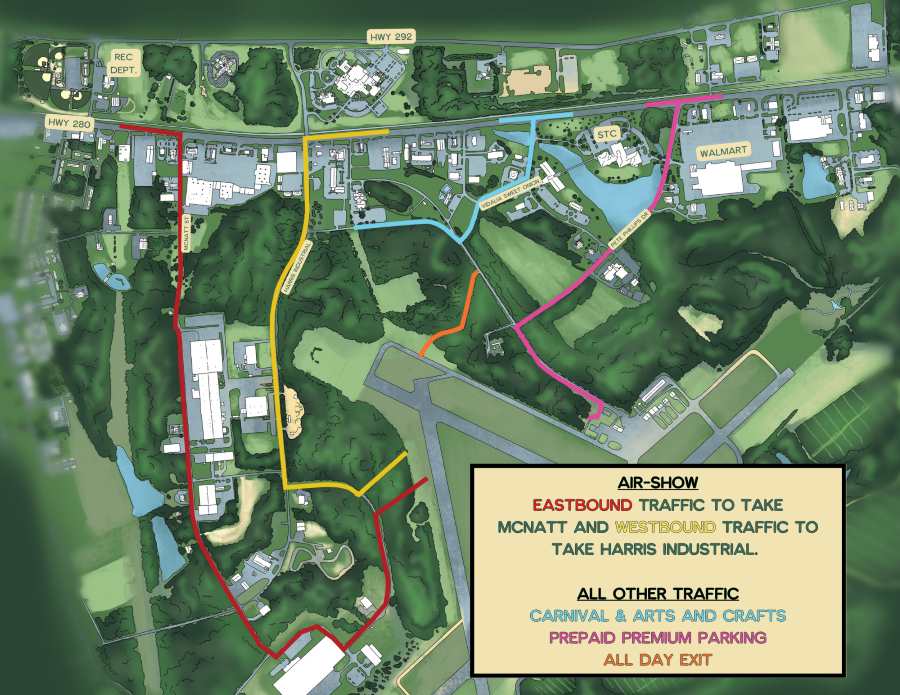

New Traffic Plan For 47th Vidalia Onion Festival

If you’re planning to go to the Vidalia Onion Festival Air Show, Arts and Crafts, or carnival this weekend, you should know that extra steps have been taken this year to minimize the traffic congestion that in the past has been an issue.

Brian Scott is the Safety and Security Coordinator for this

...- Information

- Newsbreak | | 25 April 2024 | 07:15

- 1395 hit(s) |

-

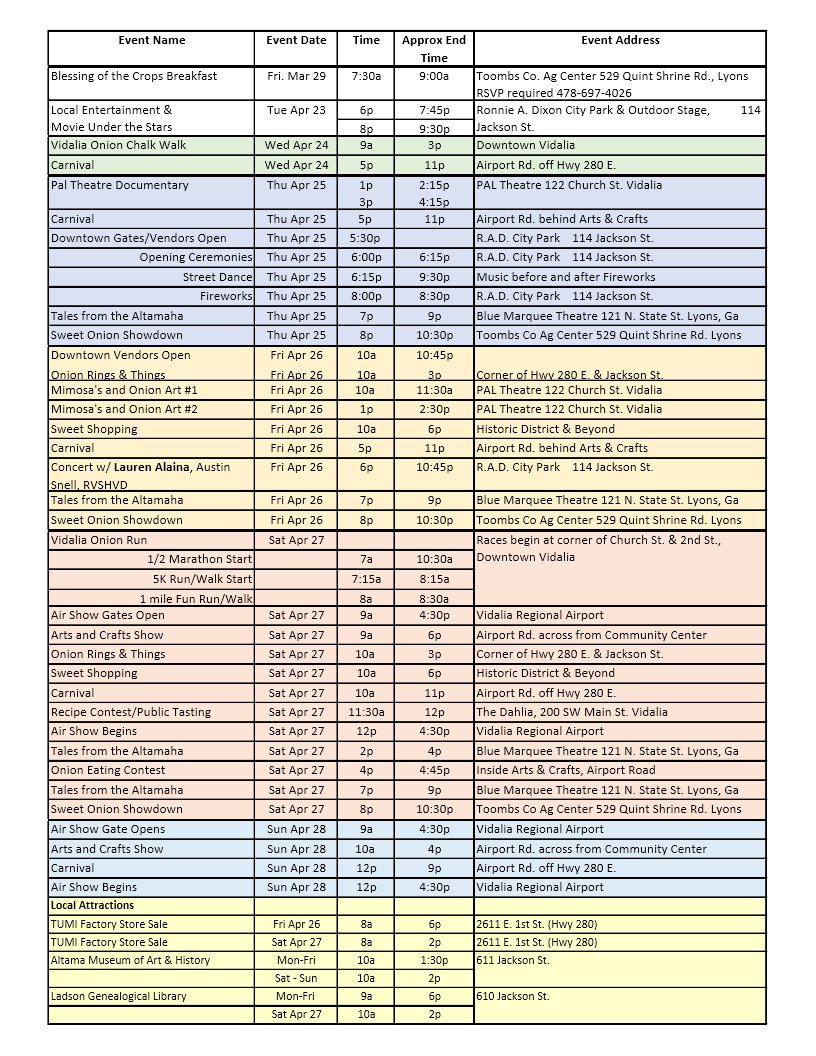

Vidalia Onion Festival Schedule of Events

Below is a complete list of events for this week's 47th Annual Vidalia Onion Festival. More info is available at www.vidaliaonionfestival.com or you can download the Vidalia Onion Festival app.

- Information

- Newsbreak | | 25 April 2024 | 06:55

- 2248 hit(s) |

-

Area Police Blotter

Vidalia Police Department reports the following arrests:

Doleman, Charles – Vidalia – Theft by Shoplifting.

Stokes, Derrick – Vidalia – DI; Failure to Maintain Lane.

Harmon, Michael – Vidalia – Criminal Damage to Property.

Toombs County Sheriff’s Office reports the following arrests:

Cesar,

...- Information

- Newsbreak | | 23 April 2024 | 11:43

- 1948 hit(s) |

-

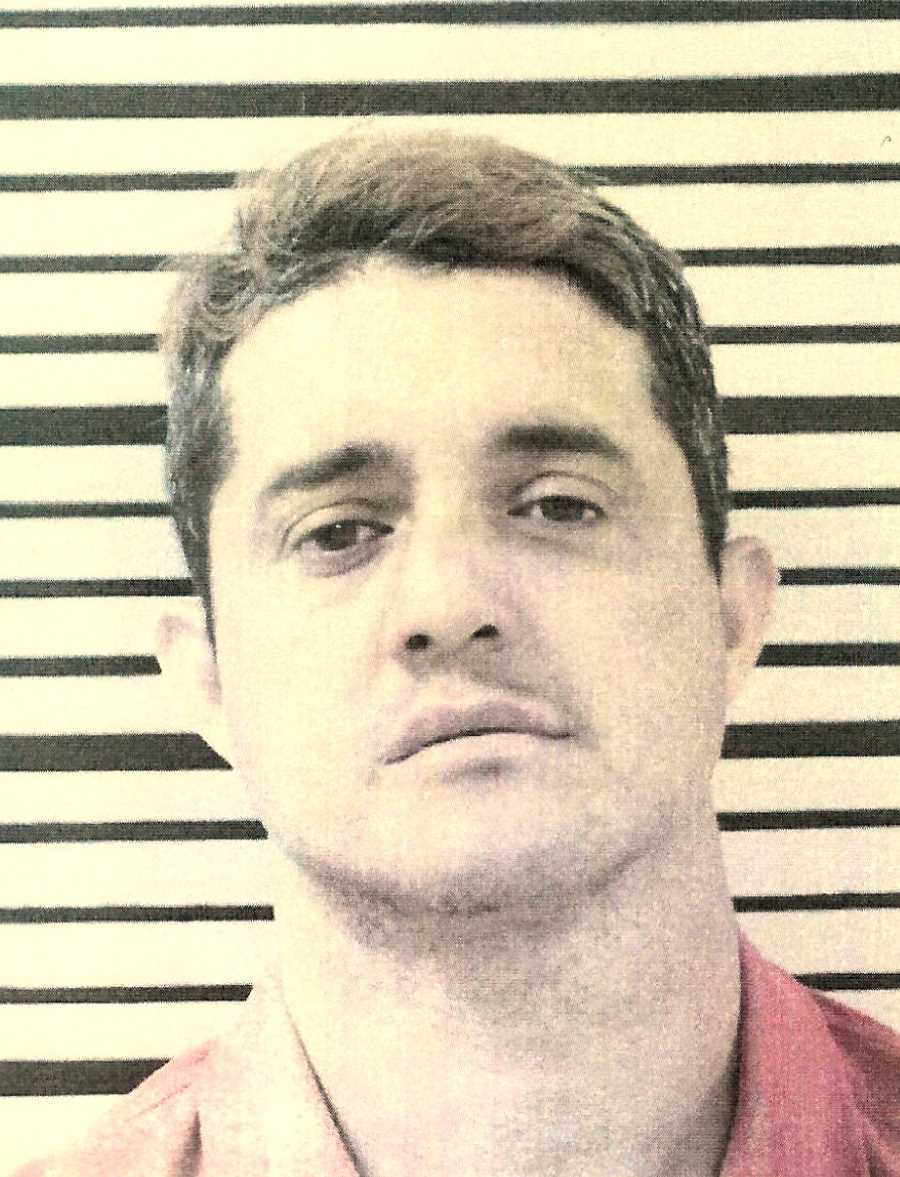

Driver in Friday Morning Accident Charged With Homicides by Vehicle

The driver of a pickup truck that was involved in an accident Friday morning on Loop Road and Old Normantown Road has been charged with two counts of homicide by vehicle, driving while unlicensed, and stop signs and yield signs violation.

Freddy Jose Suarez Juarez was behind the wheel of the truck

...- Information

- Newsbreak | | 23 April 2024 | 11:35

- 6556 hit(s) |

-

Two Killed in Friday Morning Accident

On Friday, April 19th, 2024, at approximately 9:01 am, Toombs County 911 Dispatch received a call of a wreck involving a white Ford truck and a green Chevrolet car at the intersection of GA Hwy 130 east and Old Normantown Road. Upon arrival, deputies observed that both vehicles were northwest of

...- Information

- Newsbreak | | 19 April 2024 | 15:48

- 4064 hit(s) |

-

Area Police Blotter

Vidalia Police Department reports the following arrests:

Smith, Samontray – Vidalia – Simple Obstruction; Disorderly Conduct; Terroristic Threats.

Collins, Michael – Collins – Theft by Shoplifting.

Trull, Mark Hunter - Vidalia - Theft by Taking; Entering Auto (2 Counts).

Walker, Lashunda - Vidalia -

...- Information

- Newsbreak | | 19 April 2024 | 07:34

- 3731 hit(s) |

-

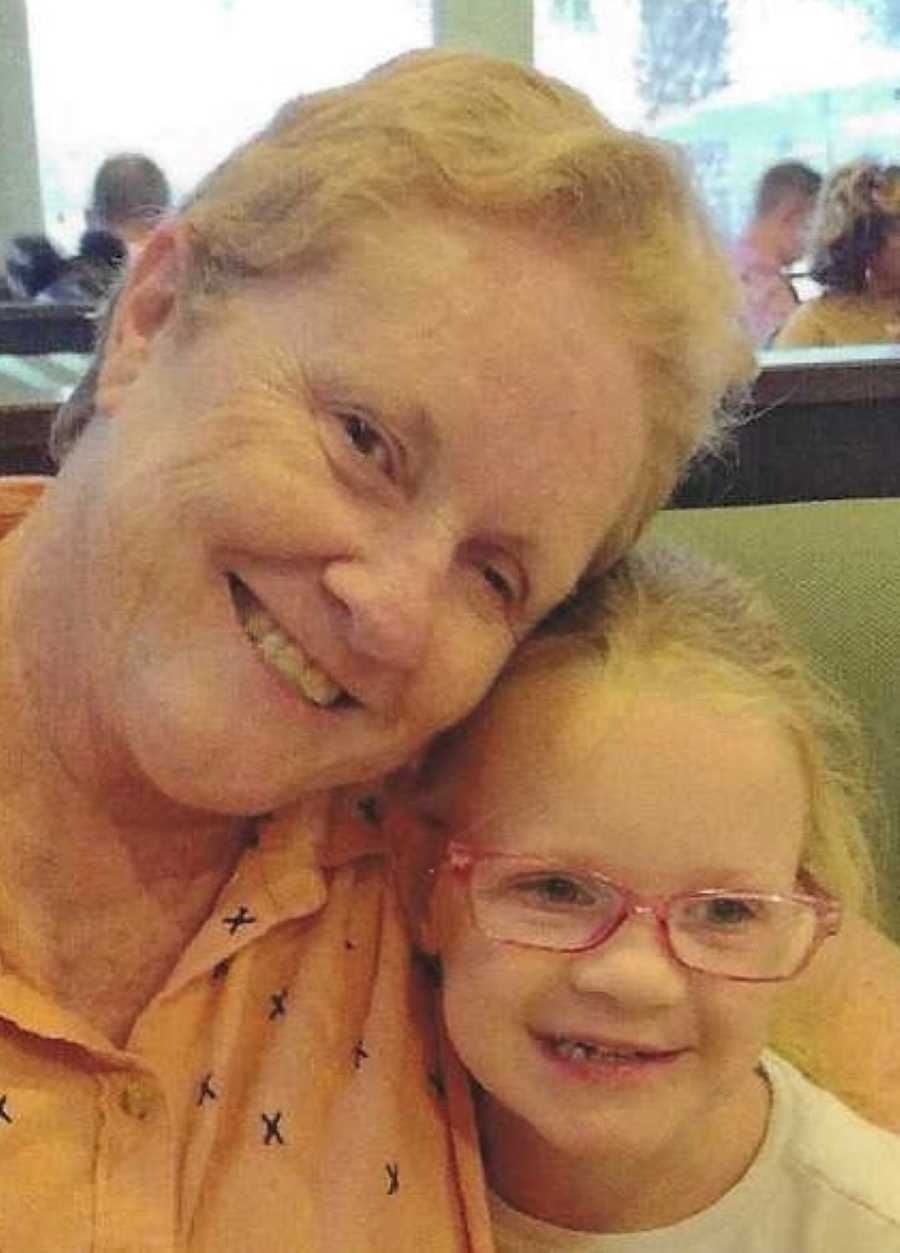

Lane Named Vidalia Lady of the Year

Angela Lane, Vidalia 2023 Lady of the Year, with her family.

When Angela Lane moved to Vidalia several years ago, she hit the ground running, and the energetic and community-loving woman has never slowed down. She immediately wrapped herself in volunteering and It’s that “giving back attitude” for her

...- Information

- Newsbreak | | 18 April 2024 | 16:33

- 1169 hit(s) |

-

Toombs County Jurors Should Not Report

Toombs County Clerk of Courts Nancy Pittman reported Thursday morning that Toombs County jurors summoned for jury duty for Monday, April 22, do NOT need to report. All cases have been settled or have been continued for the term.

- Information

- Newsbreak | | 18 April 2024 | 09:24

- 289 hit(s) |

-

Bishop Named 2023 Vidalia Man of the Year

(L to R): Zack Fowler, Presenter and 2018 Man of the Year; Brian Bishop, 2023 Man of the Year; and Lisa Bishop, wife of this year's recipient.

A familiar voice to listeners of the radio stations in Vidalia and the 2018 Man of the Year came home back to Vidalia Tuesday night to announce the name of the

...- Information

- Newsbreak | | 17 April 2024 | 15:49

- 1154 hit(s) |

Sportsbreak

-

Toombs County High School Bass Team Finishes Season at Lake Hartwell as Another Duo Qualifies for State

On April 20, 2024, Toombs County High School’s freshman bass fishing duo, AJ Bagby and Clayton Williams, showcased their angling skills at the GHSA Lake Hartwell Bass Tournament. Competing against a field of 247 boats, AJ and Clayton secured a commendable 26th place finish by catching a five-bass

...- Information

- Sportsbreak | | 25 April 2024 | 09:20

- 179 hit(s) |

-

Vidalia Spring Football Schedule Announced

The Vidalia Indians will begin spring football practice on Monday, May 6, at the Charles Wood Field practice facility to prepare for the 2024 football season. The Indians will practice for ten consecutive days, concluding with the annual spring scrimmage on Friday, May 17, at Buck Cravey Field.

...- Information

- Sportsbreak | | 25 April 2024 | 09:16

- 123 hit(s) |

-

Brewton-Parker Athletics: Men’s Golf Finishes SSAC Championship in Eighth

GREENVILLE, Ala. – The final round of the Southern States Athletic Conference Championship concluded on Wednesday for the Brewton-Parker Men’s Golf program.

The Barons wrapped up the three-day tournament in eighth out of nine teams at RTJ Cambrian Ridge in Greenville, Ala. As a team, BPC improved

...- Information

- Sportsbreak | | 25 April 2024 | 09:10

- 94 hit(s) |

-

Vidalia Takes “Rivalry Cup!!”

The Vidalia High School Golf Teams combined to win the 1st Annual “Rivalry Cup held Tuesday at Brazell’s Creek Golf Course in Reidsville.

The inaugural “Ryder Cup” style event came down to a two-hole playoff between the Indian’s Austin Mosley and Toombs County’s Vic Moore after the regular matches

...- Information

- Sportsbreak | | 25 April 2024 | 07:53

- 107 hit(s) |

-

Gracie Landrum Commits to Brewton Parker College for Bass Fishing

In a ceremony held on Monday, April 22, 2024, senior bass team standout Gracie Landrum celebrated a significant milestone in her career. Surrounded by family, friends, and teammates at Toombs County High School, Gracie proudly signed her letter of intent to continue her passion for bass fishing at

...- Information

- Sportsbreak | | 24 April 2024 | 13:15

- 506 hit(s) |

-

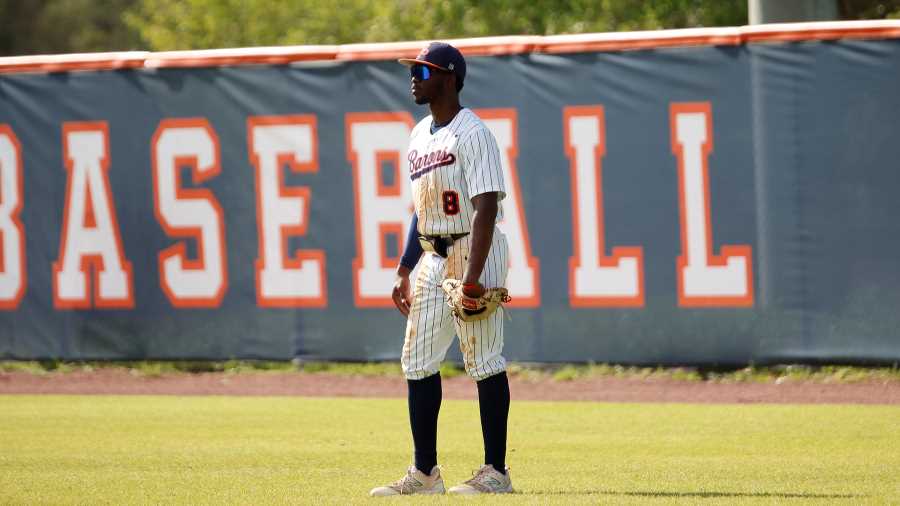

Barons Secure 2-1 Win Over (RV) Point in Game Three’s Resumption

WEST POINT, Ga. – Brewton-Parker Baseball returned to West Point, Ga. on Tuesday afternoon to resume play in the third contest of the SSAC series at (RV) Point (Ga.) which was halted on Saturday due to weather as well as poor playing conditions.

The Barons (18-26, 10-17 SSAC) downed the Skyhawks

...- Information

- Sportsbreak | | 24 April 2024 | 08:02

- 138 hit(s) |

-

Sports & Scores This Week (4-22-24)

April 22-- Here are the latest sports schedules and scores for the week.

Monday, April 22

Baseball: Braves 3, Marlins 0

Tuesday, April 23

Baseball: Braves 5, Marlins 0

Baconton Charter 5, Treutlen 2 & Baconton Charter 15, Treutlen 0 (GHSA Class A Division II First Round State Playoffs)

Toombs

...- Information

- Sportsbreak | | 22 April 2024 | 08:56

- 454 hit(s) |

-

RTCA Sweeps Memorial claims Region Title

RTCA 7 Memorial 1

...

The Crusaders traveled to Savannah to play Memorial day school Monday and behind the pitching of Britton Tabor came away with a 7-1 win in game 1 of the 3 game series. Tabor pitched 6 and 2/3 innings giving up 1 earned run and 4 hits while striking out 13. The offense was also- Information

- Sportsbreak | | 22 April 2024 | 07:04

- 124 hit(s) |

-

Bulldog Baseball Closes Out Regular Season with Non-Region 10-5 Senior Night Victory Over Metter

The Toombs County Bulldogs Baseball team ended their season with a commanding 10-5 victory against the Metter Tigers this past Tuesday night.

The Tigers initially took the lead, when a Tiger doubled to score the opening run. However, the Bulldogs quickly responded, snatching the lead in the bottom

...- Information

- Sportsbreak | | 21 April 2024 | 15:16

- 193 hit(s) |

Community Calendar

-

-

Ohoopee Soil and Water Conservation District Meeting

The Ohoppee Soil and Water Conservation District will hold its regular meeting on Tuesday, April 30, 2024, at 10:00 a.m. in the Treutlen County Library, 585 Second Street, Soperton.

Please RSVP by April 29 to NancyAnne Conner at 706-612-4020 (This email address is being protected from spambots.

...- Information

- Community Event | | 24 April 2024 | 15:33

- 32 hit(s) |

-

-

-

-

-

Vidalia Onion Festival and Technology

To stay in-the-know during the 2024 Vidalia Onion Festival, you can use this QR code to scan and go to the Vidalia Onion Festival website, or you can download the VOF app from your phone's app store. Either way, it's quick, easy, and you'll have all the latest info on the festival literally within the

...- Information

- Community Event | | 16 April 2024 | 14:23

- 201 hit(s) |

-

-

Obituaries

-

Mr. Larry Bright

Larry Gene Bright was born on August 1, 1950 in Vidalia, Georgia to the late Doreatha Jones Bright and Braddy Bright, Sr. He departed this life surrounded by those he loved to join his heavenly Father on April 20, 2024 after a brief illness. Larry received his education at Lyons Industrial High...

Larry Gene Bright was born on August 1, 1950 in Vidalia, Georgia to the late Doreatha Jones Bright and Braddy Bright, Sr. He departed this life surrounded by those he loved to join his heavenly Father on April 20, 2024 after a brief illness. Larry received his education at Lyons Industrial High... - Information

- Obituary | | 25 April 2024 | 10:05

- 285 hit(s) |

-

Pamela Connell

Pamela Diane Connell, age 64, of Milledgeville, died Saturday, April 20, 2024, from injuries sustained in a fire at her home. She was born June 5, 1959 in Vidalia to her mother Joyce Connell Ramey and father Hershel Casper “H.C.” Connell. She was a homemaker and Baptist by faith. Her family...

Pamela Diane Connell, age 64, of Milledgeville, died Saturday, April 20, 2024, from injuries sustained in a fire at her home. She was born June 5, 1959 in Vidalia to her mother Joyce Connell Ramey and father Hershel Casper “H.C.” Connell. She was a homemaker and Baptist by faith. Her family... - Information

- Obituary | | 24 April 2024 | 15:29

- 443 hit(s) |

-

Mrs. Eleanor Britt

Eleanor (Elna) Cauley Britt passed from this life into the arms of her LORD and Savior JESUS Christ on April 23, 2024 surrounded by her children. Born and raised in Treutlen County, she lived most of her life in Treutlen County, Georgia except for a three year period in the middle 1950's in...

Eleanor (Elna) Cauley Britt passed from this life into the arms of her LORD and Savior JESUS Christ on April 23, 2024 surrounded by her children. Born and raised in Treutlen County, she lived most of her life in Treutlen County, Georgia except for a three year period in the middle 1950's in... - Information

- Obituary | | 24 April 2024 | 15:24

- 873 hit(s) |

-

Ms. Nancy Jo Skipper

Ms. Nancy Jo Skipper won her battle over her earthly pain on Saturday, April 20, 2024, at Meadows Regional Medical Center in Vidalia and was called home to be with the angels above. She was 68 years old at the time of her passing. Nancy was born in the mountains of North Carolina but was adopted when she...

Ms. Nancy Jo Skipper won her battle over her earthly pain on Saturday, April 20, 2024, at Meadows Regional Medical Center in Vidalia and was called home to be with the angels above. She was 68 years old at the time of her passing. Nancy was born in the mountains of North Carolina but was adopted when she... - Information

- Obituary | | 24 April 2024 | 13:02

- 360 hit(s) |

-

Mrs. Connie Sowell, Vidalia

Mrs. Connie Thigpen Sowell, age 79, of Vidalia, died Monday, April 22, 2024, at the Community Hospice House in Vidalia. She was a native of Montgomery County, growing up in Uvalda and living in Toombs County most of her life. She was a 1962 graduate of Montgomery County High School. Earlier in her...

Mrs. Connie Thigpen Sowell, age 79, of Vidalia, died Monday, April 22, 2024, at the Community Hospice House in Vidalia. She was a native of Montgomery County, growing up in Uvalda and living in Toombs County most of her life. She was a 1962 graduate of Montgomery County High School. Earlier in her... - Information

- Obituary | | 24 April 2024 | 09:05

- 383 hit(s) |

-

Mrs. Kay Aaron, Vidalia

A “Celebration of Life Service” for Mrs. Kay Jamelle Rotton Aaron of Vidalia will be held Thursday, April 25, 2024 at 11:00 AM at her residence located at 541 Newsome Road, Vidalia, GA in Montgomery County. Reverend Baron Powell will officiate. Mrs. Aaron died Monday, April 22, 2024. Mrs. Aaron,...

A “Celebration of Life Service” for Mrs. Kay Jamelle Rotton Aaron of Vidalia will be held Thursday, April 25, 2024 at 11:00 AM at her residence located at 541 Newsome Road, Vidalia, GA in Montgomery County. Reverend Baron Powell will officiate. Mrs. Aaron died Monday, April 22, 2024. Mrs. Aaron,... - Information

- Obituary | | 23 April 2024 | 13:49

- 687 hit(s) |

-

Mrs. Marion Peterson, Lyons

Mrs. Marion Zeigler Peterson, age 89, of Lyons, died Sunday, April 21, 2024, at Haven Hospice in Lake City, Florida, following an extended illness. She was a native of Toombs County and lived in Lyons most of her life. She was a 1952 graduate of Toombs County High School, and retired from the...

Mrs. Marion Zeigler Peterson, age 89, of Lyons, died Sunday, April 21, 2024, at Haven Hospice in Lake City, Florida, following an extended illness. She was a native of Toombs County and lived in Lyons most of her life. She was a 1952 graduate of Toombs County High School, and retired from the... - Information

- Obituary | | 23 April 2024 | 12:33

- 438 hit(s) |

-

Mrs. Grace Meeks, Soperton

Mrs. Grace Parrish Meeks, age 90 of Soperton, Georgia passed away on Wednesday evening, April 17, 2024 at Langdale Hospice House in Valdosta, Georgia. Born in Treutlen, Georgia, she was the second of four girls born to the late Aubrey Talton Parrish and Mary Lucille McLendon Parrish. She grew up in...

Mrs. Grace Parrish Meeks, age 90 of Soperton, Georgia passed away on Wednesday evening, April 17, 2024 at Langdale Hospice House in Valdosta, Georgia. Born in Treutlen, Georgia, she was the second of four girls born to the late Aubrey Talton Parrish and Mary Lucille McLendon Parrish. She grew up in... - Information

- Obituary | | 22 April 2024 | 09:04

- 402 hit(s) |

-

Mrs. Sandra Cowart, Tarrytown

Mrs. Sandra Simons Cowart, age 78, beloved wife of Carl Cowart of Tarrytown passed away on Thursday morning, April 18, 2024 at Community Hospice in Vidalia. Born in Treutlen County, she was the eldest of two daughters born to the late George Dewey Simons and Loyce Poole Simons. She grew up in the...

Mrs. Sandra Simons Cowart, age 78, beloved wife of Carl Cowart of Tarrytown passed away on Thursday morning, April 18, 2024 at Community Hospice in Vidalia. Born in Treutlen County, she was the eldest of two daughters born to the late George Dewey Simons and Loyce Poole Simons. She grew up in the... - Information

- Obituary | | 22 April 2024 | 09:02

- 470 hit(s) |

Church Calendar

-

April 28--Clothing and Household item Giveaway in Vidalia

April 28--New Life In Christ Ministries Outreach Ministry, 208 Meadowbrook Street in Vidalia, is opening the doors of their "Clothes Closet" for a Clothing Giveaway, Sunday April 28th after services from 1:00 to 3:00. Clothing and shoes for men, women & children. Also, accessories & other household items. Info: Arlene Jones 912-805-0332 or Sheena Johnson 912-585-4668.- Information

- Church Event | | 24 April 2024 | 09:51

- 296 hit(s) |

-

April 28--Homecoming in Cedar Crossing

April 28--Cedar Crossing Baptist Church invites you to their Homecoming 2024, Sunday April 28th at 10:30 (no Sunday School). The Browders will be ministering during the morning service. Dinner after so bring your favorite foods. Pastor Reece Mincey

April 28--Cedar Crossing Baptist Church invites you to their Homecoming 2024, Sunday April 28th at 10:30 (no Sunday School). The Browders will be ministering during the morning service. Dinner after so bring your favorite foods. Pastor Reece Mincey - Information

- Church Event | | 22 April 2024 | 11:55

- 78 hit(s) |

-

May 4--The Barber Family in Vidalia

May 4--Cornerstone Pentecostal Church, 377 South Thompson Road in Vidalia, would like you to join them for A Night of Worship with The Barber Family, Saturday May 4th at 6:00.

May 4--Cornerstone Pentecostal Church, 377 South Thompson Road in Vidalia, would like you to join them for A Night of Worship with The Barber Family, Saturday May 4th at 6:00. - Information

- Church Event | | 09 April 2024 | 11:59

- 173 hit(s) |

-

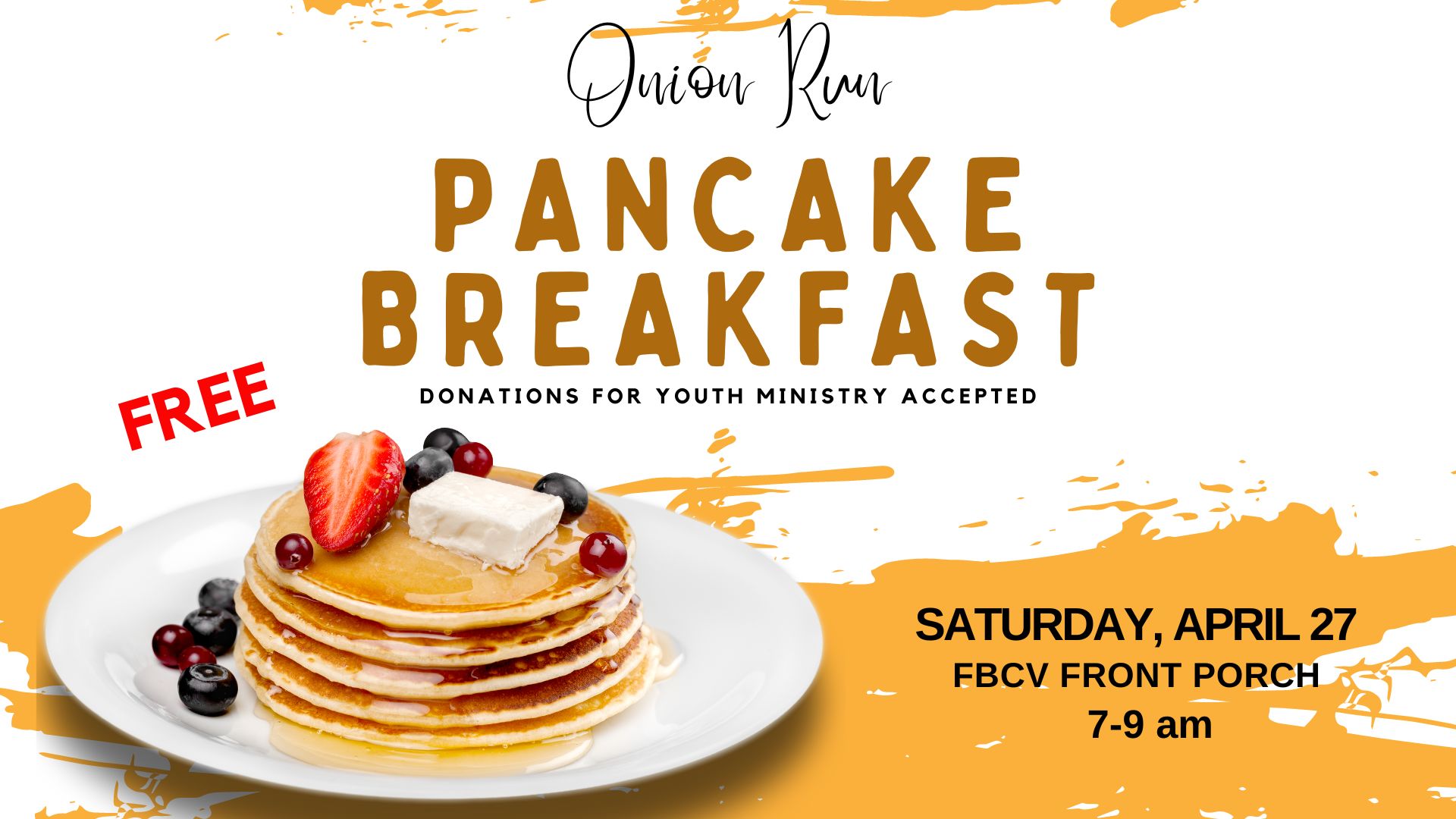

April 27--Pancake Breakfast for Youth Ministry during Vidalia Onion Run

April 27--First Baptist Church of Vidalia would like you to come to their Vidalia Onion Run Free Pancake Breakfast, Saturday April 27th from 7:00 to 9:00 on “The Front Porch”. Donations accepted for the Youth Ministry

April 27--First Baptist Church of Vidalia would like you to come to their Vidalia Onion Run Free Pancake Breakfast, Saturday April 27th from 7:00 to 9:00 on “The Front Porch”. Donations accepted for the Youth Ministry - Information

- Church Event | | 09 April 2024 | 09:35

- 432 hit(s) |

-

Pass it along with...CHURCH NEWS!

LET US GET YOUR MESSAGE TO THE PUBLIC WITH CHURCH NEWS! Thank you for using Church News on News-Talk WVOP 970 AM and 105.3 FM, and southeastgeorgiatoday.com. Submit your church events to us at least 2 weeks ahead of time for the greatest coverage and best results. Include the name of the church, the church address, name of the event, date & time of the event, location of the event if other than the church, and any special speakers involved. ** When including an image or images please send it as an attachment. Use the jpg format for all images ** Send it to JIM PERRY! Email jperry @ radiojones.com ---Please note that FAX is no longer available. Use email.

Thank you for using Church News on News-Talk WVOP 970 AM and 105.3 FM, and southeastgeorgiatoday.com. Submit your church events to us at least 2 weeks ahead of time for the greatest coverage and best results. Include the name of the church, the church address, name of the event, date & time of the event, location of the event if other than the church, and any special speakers involved. ** When including an image or images please send it as an attachment. Use the jpg format for all images ** Send it to JIM PERRY! Email jperry @ radiojones.com ---Please note that FAX is no longer available. Use email. - Information

- Church Event | | 03 November 2021 | 12:30

- 6999 hit(s) |

Meet The Staff

-

General Manager

-

Program Director

-

Program Director

-

Traffic / News Director